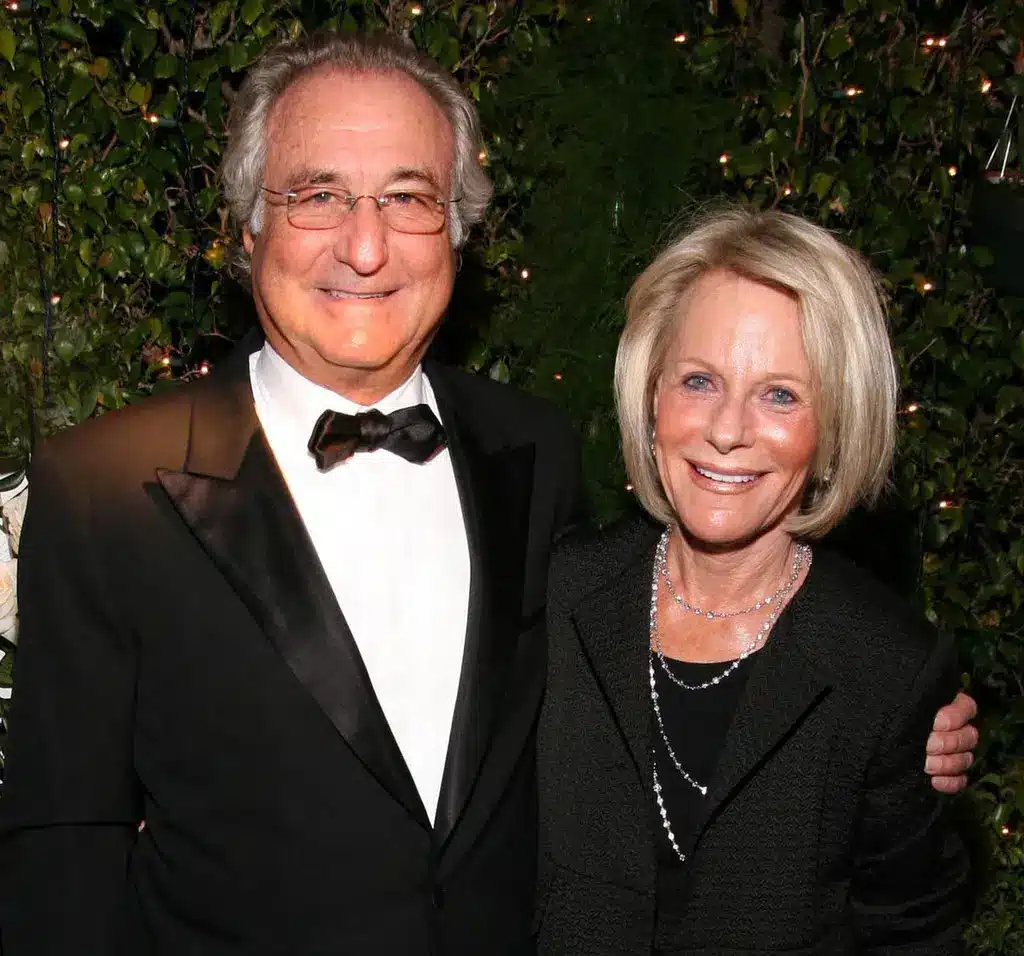

Ruth Madoff became famous around the world at the exact same time as her husband Bernie, whom she married at only 18 years old. While the wife herself isn’t to blame for everything her husband did, a lot of negative attention went towards Ruth following the catastrophic discovery of the true nature of Bernie’s business, which was in the end nothing more than a Ponzi scheme.

What really is a Ponzi scheme?

Ponzi schemes are treacherous investment operations that promise unrealistically high returns with little risk, and use money from new investors to pay off earlier ones. The term Ponzi scheme was first used in the 1920’s, when Charles Ponzi ran such an operation in Boston. Since then, numerous fraudsters around the world have used this type of scheme to defraud investors out of billions of dollars.

The basic premise behind a Ponzi scheme is simple: the operator pays returns to existing investors from the money given by subsequent ones, instead of from actual profits. This creates a false impression of profitability and encourages more people to invest, allowing the operator to take their money and run. These schemes can be difficult to spot, as they often use aggressive marketing tactics, such as offering unusually high returns, or guaranteeing a certain rate of return on investments.

Unfortunately, these schemes often collapse when the number of new investors declines, or when the operator flees with the funds. Investors who have put their money into a Ponzi scheme may never see it again, leaving them in financial ruin. One of the most notorious examples of this is Bernie Madoff, who ran a Ponzi scheme for over two decades before being sentenced to 150 years in prison in 2009.

In 2022 most people know how to protect themselves from falling victim to Ponzi schemes, as they do their research prior to actually investing any funds. They are wary of supposed opportunities that promise unusually high returns with almost no risk, checking whether their company of choice is properly registered and regulated by appropriate authorities. If something seems too good to be true in the early 2020’s, the majority knows that it is.

This wasn’t the case when Bernie Madoff was in business however, and such moneymaking schemes seemed like a real opportunity, produced by the advent of our modern age. As a result, many people around the world, ranging from store clerks to full-time professional investors ended up putting their hard-earned cash on the line for Bernie’s promises, fully believing that they were about to hit the jackpot.

What did Bernie Madoff really do?

Bernard Lawrence Madoff was born on 29 April 1938, in Queens, New York City USA. He was the second of three children, withan older brother Peter, and a younger sister, Sondra Weiner. He grew up in a middle-class Jewish family, and attended Far Rockaway High School, where he was an active member of the debating team.

After matriculating in 1956, he first attended the University of Alabama for just a year, joining the Sigma Alpha Mu fraternity’s Tau Chapter. In his second year of college, Bernie transferred to Hofstra University in Hempstead, New York, from where he graduated with a Bachelor of Arts degree in political science in 1960.

In the same year, he founded the firm Bernard L. Madoff Investment Securities LLC, thanks to a combination of the $5,000 (approximately $46,000 in 2020’s currency value) that he had earned from earlier employment as an irrigation sprinkler technician and a lifeguard, as well a $50,000 loan from his father-in-law Saul Alpern – a well-connected accountant with an illustrious career.

The firm initially focused on trading penny stocks, and was soon joined by Carl J. Shapiro who invested $100,000. His business eventually expanded to become one of the largest market makers on Wall Street, and was highly respected within the financial industry, whole makinge its CEO a very wealthy man.

One of the greatest things Bernie ever invested in was the start of what is today an irreplaceable tool for most traders around the world. It all started with his company trying to compete against businesses in the New York Stock Exchange, who were trading on the exact same floor.

Madoff was one of the few who put time and money into helping develop computer-based technology that would help spread his quotes to customers. With the machinery set up and the software polished, after a successful trial run, the National Association of Securities Dealers Automated Quotations Stock Market was brought to life, known today by its famous acronym, NASDAQ. Eventually, in 2008, his firm was declared the sixth largest market maker according to Standard and Poor’s 500 (S&P 500) stocks.

He served as chairman of the Nasdaq Stock Exchange from 1990 to 1993, and became involved in philanthropy and politics during his period, being a major donor to both Democratic and Republican candidates for office. He was an active member of several charities and philanthropic organizations as well, including the International Association of Financial Engineers, and the National Center for Victims of Crime.

Bernie’s gradual downfall

Madoff’s supposedly humane and altruistic actions helped shield him from the many accusations leading up to his own eventual admission to the whole business being fraudulent. The first such remark came from Harry Markopolos in 1999 who, as a financial analyst, simply couldn’t comprehend how such an incredible returning investment could really exist.

He sat down and did the numbers, finding that it is mathematically and physically impossible to gain what Madoff had been promising for more than a decade. After a mere four minutes of calculating and another sixty seconds of thinking, Harry spent four hours trying to come up with a way to justify Bernie’s unimaginable reported numbers, but to no avail.

He eventually reached out to multiple appropriate authorities in an attempt to warn the world of what looked to be a massive scam, but the cry fell on deaf ears everywhere. Thanks to a number of clever manipulation and investment strategies, Bernie had the ear of most officials who had the power to shut him down.

Eleven years later, after the dust of everything had settled and the truth came to light, Harry co-authored a book about his struggle along with Gaytri D. Kachroo, who was in charge of his legal team. Together, they went through various courts and lawsuits over the years, coming up with no success most of that time, due to how elaborate a fraud Bernie’s business really was.

In spite of that, not one of the major derivative firms put their trust in Madoff Investment Securities LLC. Most experts had their doubts, but no one really wanted to go out of their way and prove the falsehoods of what Bernie had been advertising for years. Without their investments, however, the whole business started heading down a slippery slope, with no chance of recovery.

https://www.facebook.com/cnbcprimetv/photos/a.788321077877165/5497993940243165/

One of the most suspicious oddities regarding the way his business operated was that it had less than five employees, with only one office and three workers, of whom there was one accountant. Even with all the numbers being accurate, it was simply inconceivable for such a tiny team to manage the billions that were flowing in and out of the firm on a monthly basis, so something else had to be at play by default.

The whole operation quickly came crashing down near the end of 2008, when there simply wasn’t enough money left in the firm to keep dishing out the unrealistic massive payments, since at that point no new investors had taken the bait for a considerable time.

Up until then, Bernie had simply been putting all of the invested funds into his business account at JPMorgan Chase, withdrawing money for payments at the customers’ request. After a massive redemption payment done on November 19, he had only $234 million in the account, which wasn’t anywhere near enough to cover the upcoming requests. He had also lost the trust of all major banks, so being unable to borrow enough to scrape by.

Bernie and Ruth’s sons, Mark and Andrew Madoff, were also employed in the company. With their reputation on the line as well, they didn’t take kindly to the news their father broke on 9 December 2008. The Madoff patriarch relayed to Mark the plan to pay out a $173 million bonus two months ahead, stating that it was a good time for such a payment, as the business had done well recently.

After Andrew also found out about the plan from Mark, the two got to thinking and ended up unable to reconcile the decision with the company’s current state of affairs. Outraged, they both went to their father’s office to ask why he’s dishing out early bonuses when the firm can’t even meet its own clients’ requests.

They all then went to Bernie’s apartment, and with Ruth on his right shoulder, the father admitted that the business is about to be upended, with no ace left to pull from the sleeve, explaining how it was all in fact just a Ponzi scheme, and never legitimate to begin with. Two days later, after the sons duly reported him, Bernie was arrested and promptly charged with securities fraud.

Madoff ended up forfeiting over $170 million in assets, and being sentenced to 150 years in prison. He died of natural causes at the age of 82 in the federal prison for those with special health needs, in Butner, California. He was ultimately cremated in Durham, North Carolina.

Breaking News: Bernie Madoff, the architect of the largest Ponzi scheme in history, has died in prison at 82. The victims of his fraud numbered in the thousands.https://t.co/Ir6jFYZaGo pic.twitter.com/0d1qtHfVOZ

— The New York Times (@nytimes) April 14, 2021

What happened to Ruth, and where is she now?

Having married her three-years-older childhood sweetheart before even reaching adolescence, Ruth had no idea what kind of ride she was in for until the bitter scandal tore her life apart. Her son Mark Madoff committed suicide two years after Bernie’s arrest, while Andrew Madoff succumbed to his lymphoma in 2014. She is the only living member of the notorious family of four, whom the world came to despise.

In the early half of 2009, with the court proceedings still underway, Ruth and her husband owned over $200 million in various assets. Most of those were seized after the verdict, however, and the Madoff matriarch soon fell on hard times. Upon slowly coming to the realization of what was to occur, the married couple attempted suicide by ingesting a lethal dose of pills, but both survived.

While most of the media attention was and will remain on Bernie, many news outlets also paid special attention to Ruth, who was the innocent bystander in the eyes of many, including the very victims of the Ponzi scheme. She was called out by various witnesses over the course of Bernie’s court proceedings, receiving a number of different sentiments throughout the process.

One victim stated ‘It pains me so much to remember my husband, a fine physician, getting up in the middle of the night and going into the hospital so that Bernie Madoff could buy his wife a Cartier watch.’ Another was even less sympathetic to Ruth, telling Bernie ‘Your wife, rightfully so, has been vilified and shunned by her friends in the community. You have a marriage made in hell.’

With the prosecution unable to provide solid evidence documenting Ruth’s involvement in the defrauding of the century, she was personally never prosecuted. Upon Bernie’s incarceration, she tried to alter her appearance by dyeing her hair red, hoping to avoid the many disgruntled neighbors who even went as far as to stalk her in the street.

On top of that, Ruth was ruthlessly hounded by the court-appointed trustee of BakerHostetler named Irving Picard, who was convinced that she had secretly retained substantial wealth. He eventually threatened to take serious legal action if she didn’t comply with his demands, causing the Madoff matriarch to plummet further into misery.

https://www.instagram.com/p/CGXCPCpBWuO/

Bernie’s lawyer asked the court to let Ruth keep $70 million in various assets, but she was only given $2.5 million in the settlement. She paid almost $600,000 from the trusts of her two grandchildren, agreeing also to surrender all assets to the court upon her death. Regardless, she was sued by Picard for $44.8 million on the grounds of living a lavish lifestyle at the cost of other people’s suffering.

He won the lawsuit with a much smaller settlement, as Ruth simply didn’t have the funds to cover even 10 percent of what was requested. In spite of winning in court, Picard did admit that his victory was in no way evidence of Ruth’s knowledge of or participation in her husband’s fraud. According to the settlement, she is obligated to report any purchase over $100 to Picard, so as to keep providing evidence of having only one bank account.

Understandably, Ruth did everything in her power to escape the spotlight, moving away to live with her sister in Boca Raton, Florida in 2010. Two years later she relocated to Andrew Madoff’s house in Old Greenwich, Connecticut. However, after he died in 2014, she moved to a one-bedroom apartment in the nearby area.

Her last known change of residence took place in September 2020, when she moved in with her late son Mark’s first wife Susan Elkin. As one would expect, considering everything that happened, Ruth evades the media at every turn, and keeps her life strictly private. She will be 82 years old on 18 May 2023 – the same age at which Bernie’s life ended.

Leave a Comment